The markets and Fed officials have both been expecting three total Fed rate cuts in 2024. This is down from the five-six rate cuts the markets were predicting about six months ago. With several reports in January and February indicating the economy appears to be either not slowing down as fast as expected, or in some cases may be growing, this has shifted the debate from two versus three cuts in 2024. The most recent comments from Fed officials have been signaling the markets for three cuts this year, but many bond investors are publicly speculating that there may only be two cuts, which is why bond prices have decline and bond yields have increased over the last several weeks.

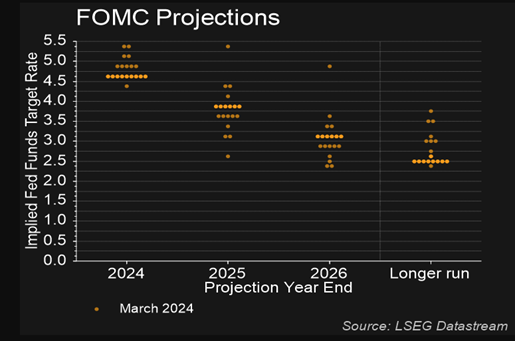

Below is the “Dot Plot” graph that shows the results of the quarterly survey of the 19 Fed members on each person’s prediction of where the Fed Funds rate will be at the end of each of the next few years. This Dot Plot represents the March survey of the 19 Fed members, of which 12 are members of the FOMC on a rotating basis. The majority vote of the 12 FOMC members occurs at every scheduled FOMC meeting, and this vote determines if the Fed makes any change to the Fed Funds rate. This graph shows us that 10 of the 19 Fed members expect the Fed Funds rate will be just a bit over 4.50% by the end of 2024, compared to its current level of 5.25 – 5.50% which implies that three cuts of 25 basis points will occur.

There will be a continuing theme of jobs related reports this week that the markets will be watching through the lens of these reports either supporting a two versus a three cut expectation for 2024? The bond markets and specifically the MBS markets will rally if the three cut argument is strengthened, and they will sell off in price if the two cut scenario looks more likely.

This Market Update and similar such communications are for informational purposes only and are based on publicly available information. These materials are general communications, which are not impartial, and are provided solely for discussion purposes, and not in connection with any product or service offering. The opinions and views expressed in this Market Update are as of the date of this communication and are subject to change. Any forward-looking views and statements contained in this Market Update are based on current estimates or expectations of future events or results. Actual results may differ materially from those described in this Market Update. The views expressed in this communication should not be attributed to Guild Mortgage Company as a whole and may not be reflected in the strategies and products offered by Guild Mortgage Account.

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW