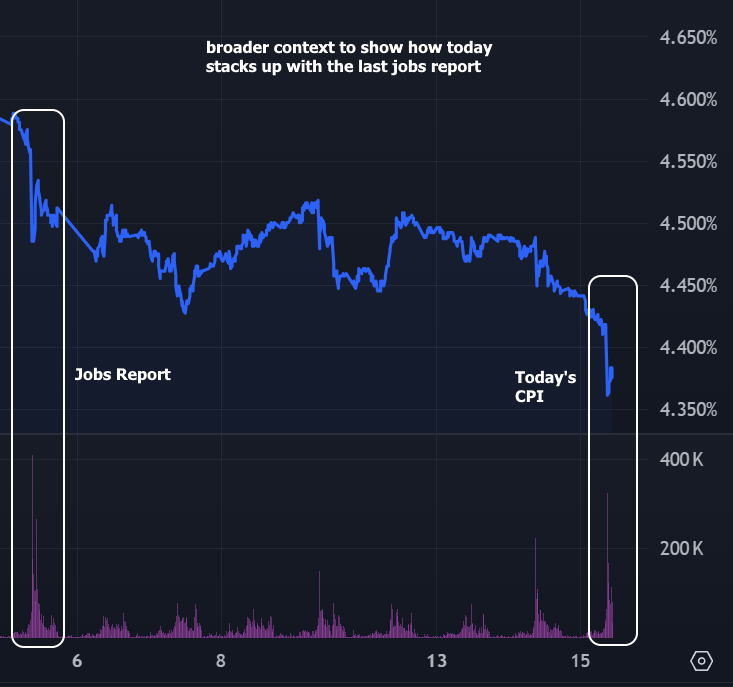

The Core CPI inflation report for April came out exactly as the market had predicted, at a 0.3% monthly increase in consumer prices, with an annual rate of increase of 3.6%. This was a decline from the prior month’s increase of 0.4% and the prior annual rate of 3.8%. Also, this morning the April Retail Sales report was released showing a 0.00% increase in April over March, which was below the market’s prediction of a 0.4% monthly increase.

These two reports are bolstering the market’s hopes of a cooling economy starting in the second quarter of this year, which could set the stage for the Fed to do their first rate cut in September. Easing expectations for future inflation rates and the increased probability of a Fed rate cut in September are both good for the bond markets, and as a result, MBS prices are presently about 40 basis points better than yesterday morning, and the yield on the 10-year is presently 4.348% which is a nice decline of about 12 basis points from yesterday morning, is its lowest level in the last five days!

This it pushed the average 30yr fixed mortgage rate under 7% for the first time since early April.

Mortgage Rates Back Under 7% After Inflation Data (mortgagenewsdaily.com)

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW