This is from Mortgage News Daily and I found it interesting….so thought I’d share! Link to article below.

By: Matthew Graham. Friday November 1st.

It is our longstanding policy to strictly avoid politics except in cases where the political realm legitimately intersects with relevant events for rates. Now is clearly one of those times. The discussion that follows contains no opinion or partisan leaning.

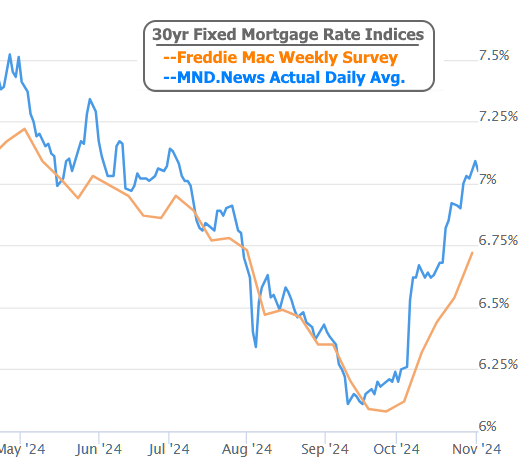

Before getting started, let’s catch up with mortgage rates. Things haven’t been great and much of the media coverage focuses on Freddie Mac’s stale weekly survey number. Actual daily averages are already much higher. Today didn’t offer any material change on that front, leaving us free to focus on what may lie ahead.

There is an objective correlation between various measures of the election outcome and recent rate movement. Correlation is not necessarily causality, but comments from several high profile investors have bolstered the case for a Trump victory resulting in higher rates. Notably, many of them qualify that by saying it’s more about the opportunity for full republican control of Congress and The Oval Office (i.e. the red sweep).

On one hand, there is certainly correlation here. On the other hand, it’s far from perfect. Additionally, there are other key events in this time frame that definitely account for a good deal of movement in interest rates–possibly enough movement to think twice before assuming we can even know how rates would react to the election.

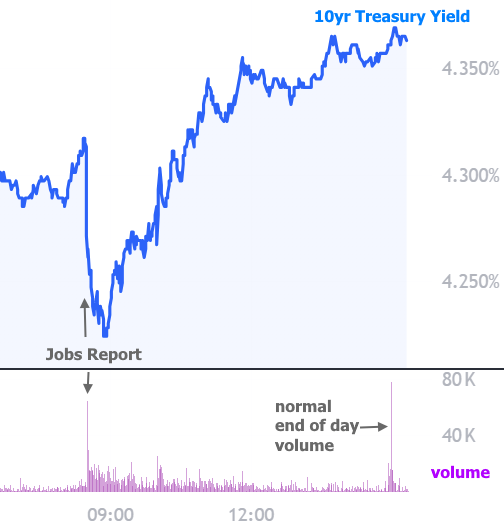

Today’s jobs report reaction provided the latest reason for doubt. Rates refused to drop after a weak jobs report–something they’d normally be happy to do. There was an initial, reflexive drop in 10yr Treasury yields, as seen in the chart below, but it was quickly erased. Treasury yields are well-correlated with mortgage rates. A chart like this can show us intraday momentum in the bond market whereas mortgage lenders only update mortgage rates 1-3 times a day depending on volatility. This was a relatively low volume move for a jobs report-further suggesting the market’s mind is elsewhere.

Wherever “somewhere else” is, it doesn’t necessarily have perfect if/then rules. For instance, one could have easily assumed the lack of reaction to the jobs report was due to pre-election trading, but the problem is that Trump’s victory odds were decreasing somewhat sharply at the same time that rates were rising–the exact opposite of the prevailing logic.

This doesn’t prove or disprove anything about the broader trend in a conclusive way. It also doesn’t mean the market wasn’t thinking about the election. It may be as simple as the pre-election trading simply not being a simple if/then. So simple!

Here’s what we can objectively know when it comes to the bond market’s sentiment:

- The memory of the 2016-2018 rate spike is still relatively fresh in investors’ minds, and that likely contributes to a bit of association between Trump and higher rates.

- Many investors view EITHER candidate as being bad for rates because both are expected to continue adding to Treasury issuance needs (the single most fundamental reason that rates would rise, and a key reason they’ve risen so much post-covid).

- Harris represents more of a status quo for most investors, and that status quo does nothing to organically push rates lower.

- Trump represents a greater chance of policy surprises, which can be either good or bad for rates. A popular refrain has been that tariffs would increase inflation and, thus, rates. But 2019’s trade war with China is generally seen as putting downward pressure on economic activity and interest rates.

- Trump represents a greater chance of full control of the government by one party, something that is generally associated with upward pressure on rates because it lowers the barriers to a net revenue shortfall. The quintessential examples of this would be democrats spending more without raising taxes enough to cover the costs or republicans taxing less without lowering spending enough to offset the costs. Both are bad for rates, but polling/betting odds suggest a far greater chance of a red sweep vs a blue sweep.

- Last but not least, we can objectively know that traders aren’t dumb enough to believe that every little campaign promise and speculation will be implemented as policy.

That last point is particularly important. It’s not as if the market is assuming it knows exactly what will happen based on the election outcome. If anything, the recent rate rout could just as easily be seen as a combination of:

- The tone of economic data in October (especially the last jobs report)

- A general dissatisfaction with the fiscal outlook for both parties

- A normal urge to “move to the sidelines” ahead of a major event.

One item in that list begs the question: if the last jobs report was such a big deal for rates, why didn’t this week’s installment help? After all, nonfarm payrolls came in at a paltry 12k versus a median forecast of 113k and a previous reading of 223k. In any other reality, that would have sent rates plummeting. Why not this time?

First off, as we warned last week, the market was planning on taking the payroll count with a grain of salt due to distortions caused by extreme weather and other temporary events. That left the unemployment rate as the most important line item this time around, and that was perfectly on target with forecasts. Additionally, wages and hours worked were both higher than expected (not a huge market mover, but not good for rates, all other things being equal).

Then, of course, there is a very legitimate argument against any trader betting too heavily on rates moving lower until there is clear-cut justification to do so. That means we’re waiting for the election outcome at the very least and possibly for a string of significantly weaker economic data (without the “yeah buts” associated with this week’s jobs report).

What can we expect next week? At the very least, we’ll learn a lot more about how much of the past month of pain was truly driven by politics. The safest expectation is for lots of volatility–something that can play out in EITHER direction. In other words, if you’re waiting for rates to drop after the election, you have a 50% chance of being disappointed. If traders could already know that rates would drop after the election, they wouldn’t wait to trade it.

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW