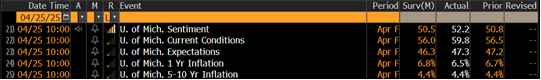

Happy Friday! Today’s sole data release of significance was the April University of Michigan Consumer Sentiment Survey, which fell to one of the lowest readings on record. April’s reading of 52.2 was down from 57 a month earlier, although was slightly higher than the expected 50.8 that most economists expected. Within that survey we saw long-term inflation expectations rise to the highest levels since 1991 as consumers anticipated inflation will rise to a pace of 6.5% over the next year and continue at a 4.4% pace over the next 5-10 years. All of this is being driven by fear of the potential economic fallout from tariffs and the impact those may have on not only inflation, but also income growth, unemployment, and of course rising prices.

The 10-year Treasury Yield was hovering right around 4.30% overnight, down slightly throughout the day yesterday, with continued easing to start the day off today. It currently sits at 4.27%, while most Mortgage-backed Security prices are slightly improved from where we ended the day yesterday. We’ve continued to see some volatility in Treasuries over the past few trading sessions, although for the most part this week has been a bit of “wait and see” for the market as we await the release of top-tier information next week (more on that below).

Below is the 5-day chart of the 10-year Treasury yield: NOTE that down for yield = up for rates.

Tariffs

Tariffs continue to take the spotlight and drive the recent volatility we’ve seen across all markets. News out this morning suggesting China is considering suspending its 125% tariff on certain US imports was received well by markets, despite confusion over the past day or two on whether the US and China are really in negotiations (Trump administration said they are, while China claimed they are not). Hopes of reaching an agreement as soon as next week on tariffs with certain countries like South Korea and others is also being rumored and would help in relieving some of the current uncertainty in markets.

This Market Update and similar such communications are for informational purposes only and are based on publicly available information. These materials are general communications, which are not impartial, and are provided solely for discussion purposes, and not in connection with any product or service offering. The opinions and views expressed in this Market Update are as of the date of this communication and are subject to change. Any forward-looking views and statements contained in this Market Update are based on current estimates or expectations of future events or results. Actual results may differ materially from those described in this Market Update. The views expressed in this communication should not be attributed to Guild Mortgage Company as a whole and may not be reflected in the strategies and products offered by Guild Mortgage Company.

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW