The first time applying for a mortgage, you’re immersed in a whole new world of financial vocabulary and acronyms. DTI, LE, CD, escrow, cash to close, amortization, it’s a lot to keep track of! So what is amortization and how does it work?

What Does Amortization Mean:

The word “amortization” has several definitions, but in home lending, amortization is the process of paying off debt through regular principal & interest payments.

How It Works:

Your mortgage payment never changes (unless you have an adjustable mortgage). However, the way your monthly payment is applied to principal vs. interest adjusts constantly.

Here’s how the math works. To calculate your interest payment each month, the servicer divides the interest rate by 12 and then multiplies that number by the outstanding loan balance. This is the portion of your payment that is applied to interest that month, the rest goes towards the principal loan balance. In the beginning, you pay more in interest and less in principal. Each month, you’ll see more & more going toward principal until the loan is paid off.

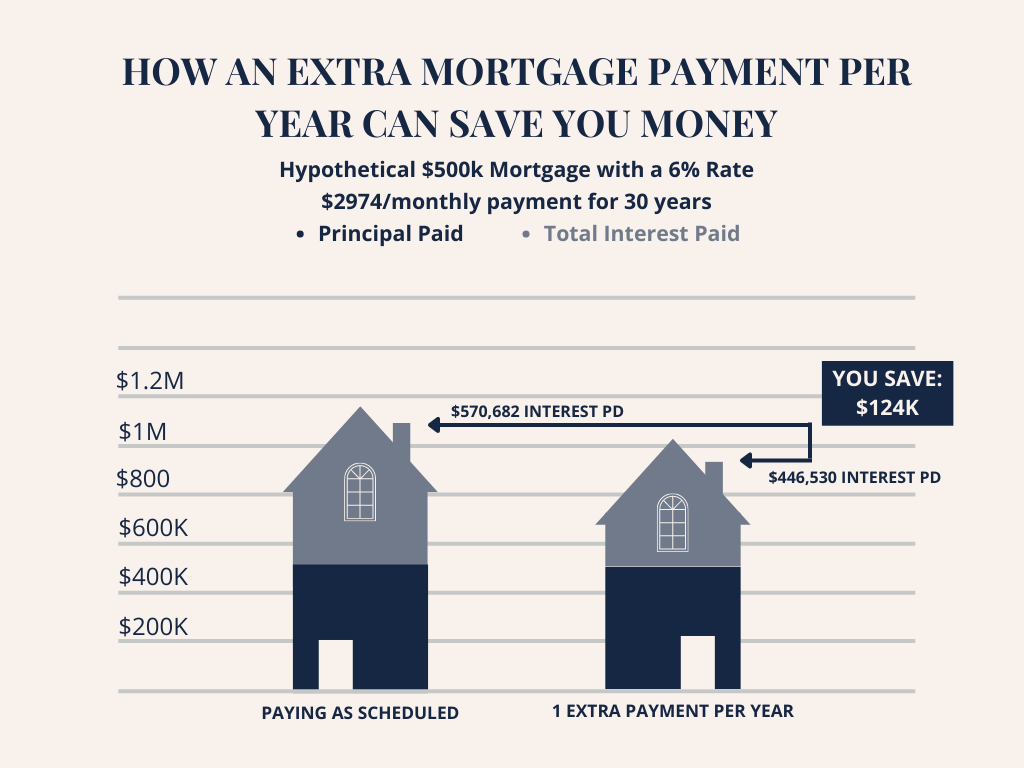

This is how one extra payment a year can take years off the life of your loan and save you thousands. Most people can’t come up with an extra mortgage payment all at once, but if you divide your monthly payment by 12 and add that to your payment each month, over the course of a year, you’ll make an extra payment.

Here’s an example with a monthly payment of $2400.

2400 ÷ 12 = $200

You pay $2600 each month instead. The nice thing about this method is that it’s optional. If you’re having a tight month, you can revert back to your $2400/month payment with no issues.

**One thing to note: be sure that your servicer is applying those extra payments correctly. You’ll be able to see how they’ve applied extra payments on your monthly mortgage statement.**

The Bottom Line:

Amortization is how you pay off your mortgage through regular principal and interest payments. When you initially get your mortgage, you’ll receive an amortization schedule. That schedule shows each payment and how it will be applied. You have the option to make extra payments towards principal though. Making extra payments towards your mortgage has the potential to take years off the life of your loan and save thousands in interest.

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW