Since the NAR (National Association of Realtors) settlement regarding real estate commissions, there has been a lot of discussion and worry about how this will affect buyers, sellers, and agents. Below I’ll go over what we know, what hasn’t changed, recent clarification and current IPC limits chart.

The facts of the settlement have 3 provisions due to go into effect in July 2024:

#1) Prevent agents’ compensation from being listed on multiple listing services.

#2) Agents must also negotiate and document payment terms with their buyers before showing homes. This agreement is referred to in many states as a “Buyer’s Agency Agreement” or “Buyer’s Broker Agreement”. This change aims to enhance transparency in the homebuying process.

#3) Agents can’t claim services are free unless they truly are, to avoid deception.

Missconseption:

There is no rule saying that sellers cannot pay buyer’s agent commissions or continue to do cooperative broker fee agreement as in the past.

Announcement/clarifications as of April 15th

This week Fannie Mae, Freddie Mac, and FHA all came out with clarifications on how they interpret seller credit IPC (interested party contributions) and buyer’s agent commissions.

They stated that because a buyer’s agent commissions are a “standard and customary” cost usually paid by the seller, any normal and reasonable agent commissions paid by the seller would not count towards IPC limits of what the seller can pay towards buyer closing costs.

NOTE: VA has not made any changes or clarifications yet. So, no changes to current VA policy which prohibits sellers or buyers paying realtor commissions. Agent commissions would still need to be paid through a cooperative broker fee agreement.

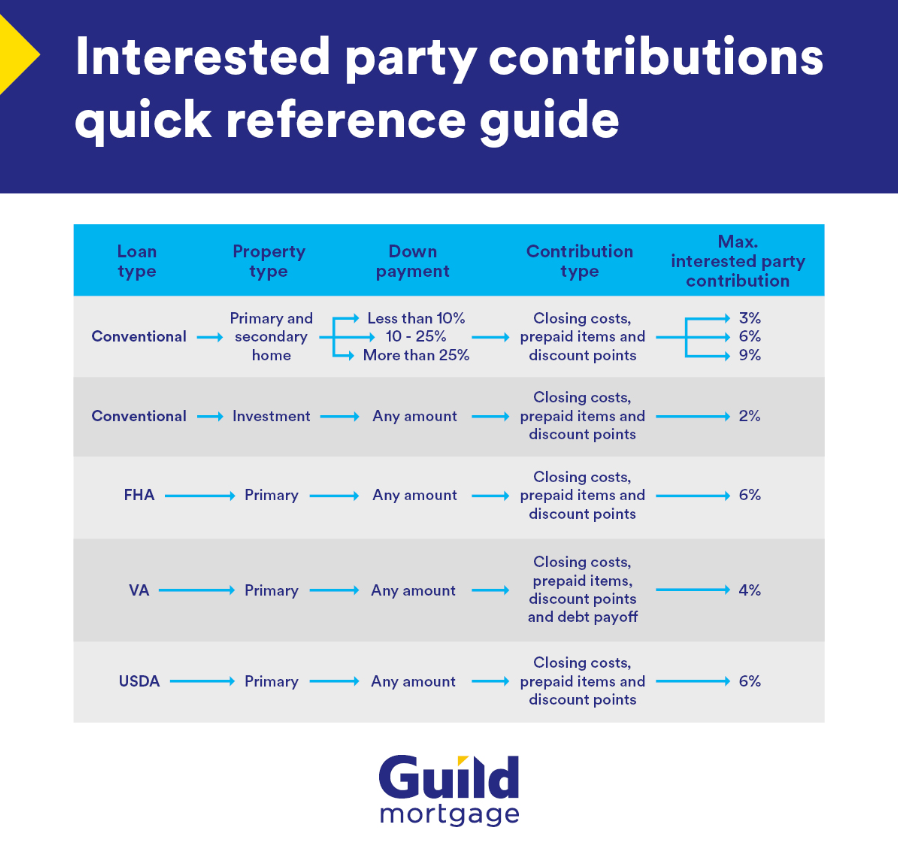

Current IPC limits chart to reference:

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW