Our recent focus has been on the FED and when they will begin their rate cuts this year. Inflation has been staying stubbornly high and the delay in when they’ll start cutting the FED rate has pushed mortgage rates “higher for longer” as they have said.

While the FED is important to rates, it specifically affects business and consumer rates such as auto loans, credit cards and home equity loans. The effect on mortgage rates is a little more indirect but still a factor.

However, the Treasury department snuck out an announcement on Tuesday (4-23) that they will be announcing a T-Bill (bond) buyback program next week!

This hasn’t made the front page of any news yet but could have a much more dramatic effect on mortgage rates then the FED!

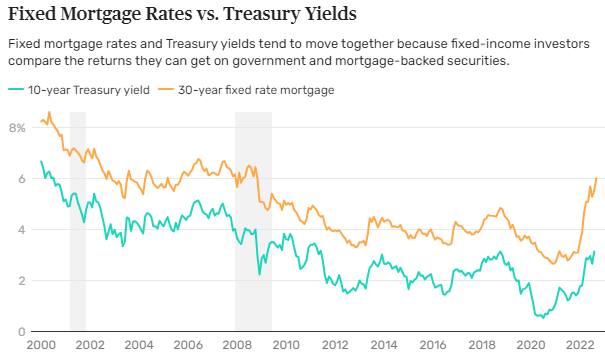

As I mentioned above, the FED rates are tied directly to consumer loans however “long term” loans, such as a 30-year fixed mortgages, are tied directly to T-Bills by competing for the same investor.

Below is a clip of the 10yr T-Bill and 30yr fixed mortgage to see the coloration:

It will be interesting to see how this announcement next week will affect mortgage rates but I’ll be watching!

Here are a couple links to interesting articles that provide a little more info if you’re interested.

Relationship Between Treasury Notes and Mortgage Rates (thebalancemoney.com)

A focus on what you're building.

MORTGAGE EDUCATION | LOANS | REAL ESTATE RESOURCES

I am licensed to do business in the states of OREGON | WASHINGTON | CALIFORNIA

© MIKE HOUGHTON 2022

BRAND & SITE BY THREE FIFTEEN DESIGN

Contact

Cell: 503-679-1848

Address:

9755 SW Barnes Rd #600

Portland, OR 97225

Navigate

HOME

ABOUT

BUYERS

AGENTS

LOAN OFFICERS

TESTIMONIALS

BLOG

CONTACT

NMLS #291980 | Company NMLS#3274 | OR ML-176

Guild Mortgage Company; Equal Housing Opportunity

Licensed by the Department of Financial Protection and Innovation under the California Mortgage Lending Act

APPLY NOW | LEGAL

APPLY NOW